As of 31 December 2024, the Home Office introduced significant updates to its guidance for sponsors of Skilled Workers and Temporary Workers. These changes explicitly prohibit employers from passing specific sponsorship costs onto workers, reinforcing compliance requirements for sponsors. This article explores the key updates, legal implications, and best practices for employers to protect their business and sponsor licence.

Key Updates from the Home Office

Prohibition on Passing Costs to Sponsored Workers Effective Date: 31 December 2024

The Home Office updated its Guidance to include a new paragraph (L6.17), prohibiting sponsors employers from passing certain costs onto sponsored workers. The paragraph provides:

"L6.17. You are responsible for paying the sponsorship fees listed above. We will normally revoke your licence if you recoup, or attempt to recoup, by any means, the following fees from a worker you are sponsoring:

• the Skilled Worker sponsor licence fee (including the fee for adding that route to your existing licence) and any associated administrative costs (including premium services) where you recoup, or attempt to recoup, that fee or those costs on or after 31 December 2024

• the Certificate of Sponsorship fee for a Skilled Worker, where that Certificate was assigned on or after 31 December 2024

• the Immigration Skills Charge for a Skilled Worker or a Senior or Specialist Worker, where you are required to pay this"

Explicit Prohibition Reinforced

The Home Office updated another Guidance on 01 January 2025 by adding a note to paragraph S2.12:

"If you are a Skilled Worker sponsor, and you assign a CoS to a Skilled Worker on or after 31 December 2024, you must not recoup, or attempt to recoup, by any means, any part of the CoS fee from a worker you are sponsoring. If you do, we will normally revoke your sponsor licence."

Legality of Repayment Clauses Prior to 31 December 2024

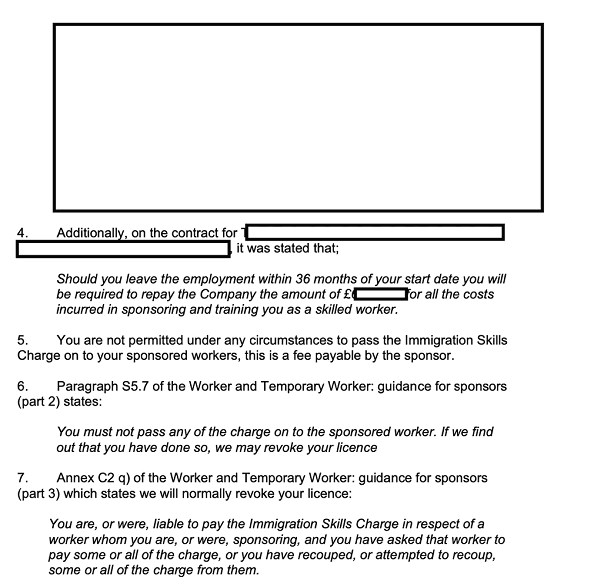

Even before these updates, sponsors were not allowed to pass on the Immigration Skills Charge to sponsored workers (Paragraph S5.7 of the Guidance). The updates in the Guidance make explicit that sponsor licence fees and associated costs are also prohibited from being recouped. Employment contracts that previously included repayment clauses covering COS costs were already non-compliant.

Failure to Comply: Suspension and Revocation

Failure to adhere to these updated requirements can result in severe consequences, including:

- Licence Suspension: Temporary loss of the ability to assign CoS to workers, and face investigations.

- Licence Revocation: All sponsored workers must leave the UK or switch to a different employer within a short time frame.

- Reputational Damage: Non-compliance may result in negative publicity and loss of trust from employees and stakeholders.

- Financial Losses: Costs associated with defending against revocation or applying for a new sponsor licence after a cooling off period and recruit workers again.

And loss of productivity if sponsored roles cannot be filled.

Example Suspension Letter

Can you still have a clawback clause

Clawback provisions in employment contracts are not entirely unlawful. Employers can still include clawback clauses related to other payments and benefits. The High Court, in a recent case, Steel v Spencer Road LLP [2023] EWHC 2492 (Ch) (Steel Case), upheld clawback provisions in employment contracts requiring repayment of a bonus upon termination, finding such provisions were not an unreasonable restraint of trade. This indicates that clawback clauses may still be valid in specific contexts.

Employers can still leverage "golden handcuffs" effectively.

Best Practices for Employment Contracts

Review all existing employment contracts for compliance with the updated guidance.

Ensure repayment clauses explicitly exclude prohibited costs.

Clearly specify the scope of repayment clauses to avoid any ambiguity that might lead to non-compliance.

Conclusion

The Home Office's recent updates underline the importance of compliance for sponsors of Skilled Workers and Temporary Workers. By proactively reviewing employment contracts, educating internal teams, and seeking legal guidance, employers can ensure they meet regulatory requirements while safeguarding their sponsor licence and business reputation.

Taking these steps will not only mitigate risks but also demonstrate a commitment to ethical employment practices in an increasingly regulated environment.